Leasing of Renewable Energy equipment

Description

Leasing enables a building owner to use a renewable energy installation without having to buy it. The installation is owned or invested in by another party, usually a financial institution such as a bank. The building owner pays a periodic lease payment to that party.

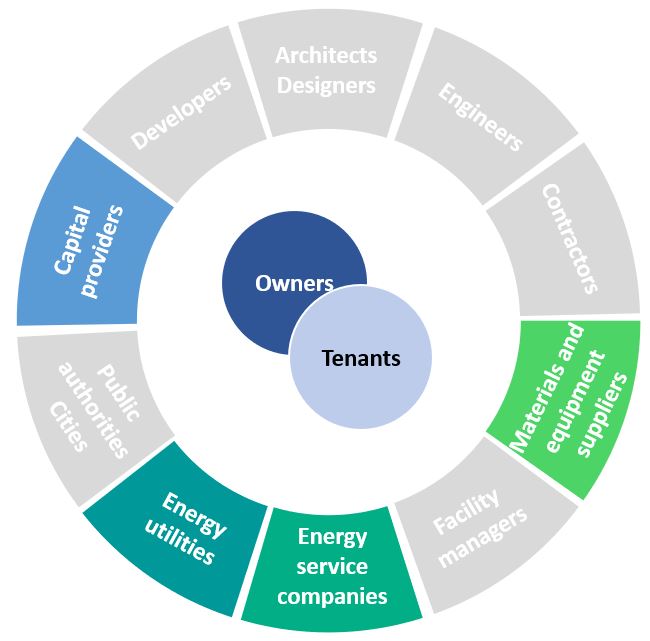

This business model consisting in leasing Renewable Energy Technologies (RET) offers new opportunity for building owners to use RET without having to make an upfront investment. It is applicable to large scale equipment in commercial buildings and in some cases to small-scale devices for private home owners, for instance RET such as photovoltaics. The opportunity to lease equipment may be part of an energy services package offered by an Energy Service Company (ESCO), but may also be offered on its own, especially in the case of individual residential customers. In addition to RET, leasing may be available for energy equipment and installations like condensing boilers, small and micro-CHP systems.

Generally, the actor who offers the lease (i.e. the lessor) remains owner of the asset during the lease period. However, several types of leasing are possible, which differ in ownership and other economic, legal and fiscal conditions. There are two main types of leases: operational lease (or operating lease, usually treating as renting) and financial lease (or capital lease, usually treated as a loan. In that case, there is a an ownership transfer option at the end of the lease period).

Leasing can be a central component of the business model of an ESCO having limited own capital (and therefore limited access to debt), which in this case may lease equipment from a financial institution. The ESCO then installs the equipment at the premises of its customers as part of the services that it offers. However, building owners may also finance RET via leasing without the involvement of an ESCO.

Leasing can also be a central component of the business model of a company that introduces a specific new technology to the market. Company providing the technology can offer it to property owners via a leasing arrangement, including a service and maintenance package.

In brief, the different scenarios can be illustrated as follow:

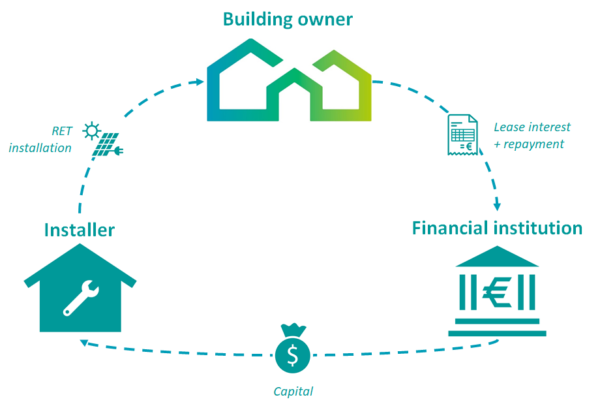

- A bank acts as the lessor of RE equipment. The building owner leases – for instance – a solar water heater directly from a bank, which owns the equipment. In exchange the building owner pays a periodic lease rate during the contract period which includes a lease instalment and interest share:

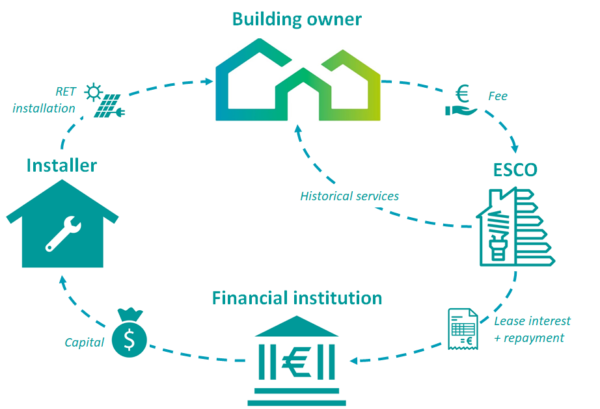

- An ESCO undertakes the negotiations with the financial institution, provides additional services to the building owner and acts as the tenant of the equipment, which is still owned by the financial institution. The advantage of the involvement of an ESCO is that the ESCO can act as a facilitator:

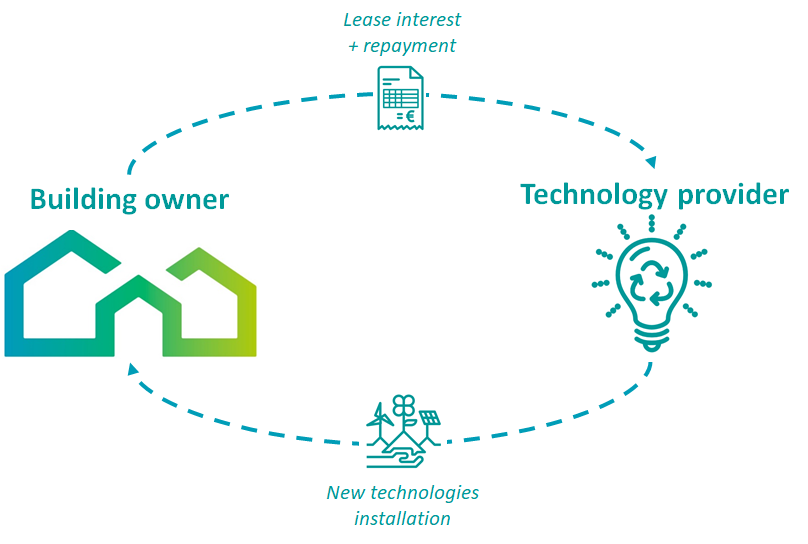

- A provider of a specific technology, such as a micro-CHP system, leases the system to private or commercial customers. This approach is mostly used by companies who want to bring a new technology into the market, and must compete against established technologies, traditional institutional areas of influence and potentially long supply chains to individual customers. The technology provider usually also provides operation and maintenance services for the equipment:

Leasing is however not frequently used for RET (and even less for EE solutions). One reason for this is that not all RET can be leased. Generally, any equipment totally integrated in a building has to be owned by the building owner. If installed technologies become part of the building, an operational lease is impossible because for this type of lease the ownership has to remain with the lessor. Another reason is that regulation usually requires that after the leasing period, an asset can be reused in reasonable state at a different time and place. This criteria is referred to as ‘fungibility’. RET systems such as soil or water-based heat pumps do not meet this criteria as the complete system cannot be removed without substantial damage. Similarly building insulation, which is often a very suitable energy efficiency measure, cannot be removed after the end of the lease term.

"What” (value proposition)

For a building owner / user:

- Leasing of equipment provides to a building owner or occupier the opportunity to use this equipment without initial investments, helping to overcome the barrier of high up-front costs;

- The building owners may profit from additional services through leasing via an energy service contractor, such as specific financial, legal, fiscal and administrative consultancy, and operation and maintenance services. This may imply lower financing costs (due to better understanding of the risk by the lessor) and lower transaction costs and effort for lessee;

- Leasing terms are generally more flexible than for a loan. For example, banks are more flexible in setting lease periods;

- Leasing can be structured in a way that makes optimal use of subsidies and tax deductions;

- By leasing off the balance sheet, the building owner or ESCO can access additional financing to invest in other assets (in the case of operating lease).

For an ESCO that leases equipment from a financial institution:

- Leasing is more flexible than debt because it can be used to finance part of a project.

For a technology provider that leases out equipment:

- The company can keep the responsibility for maintenance which may be important for technologies which are just coming in the market or for technologies requiring many maintenances, e.g. CHP systems based on gas engines;

- Leasing provides an opportunity to distribute a technology that is too costly to be sold but generator of cost savings over its life-time;

- Leasing provides an opportunity to distribute an energy technology in which customers may not trust because unknown and considered risky, e.g. fuel cells.

"Who” (target customer)

The leasing business model can be applicable to all types of buildings.

"How” (value chain, activities, resources)

Usually an ESCO or a building owner takes a lease while a financial institution or bank provides it. Also, a company aiming to introduce a new technology to the market may offer leasing of this technologies to a building owner or user.

"Why” (revenue model and cost structure)

Leasing involves a temporary financing contract between a party (the ‘lessor’, such as a bank) that provides an asset (such as a renewable energy technology) to another party (the ‘lessee’, such as a building owner) which wants to use the asset for a certain period. The lessee pays in exchange a periodic payment for the lease to the lessor. In this way, the lessees do not need to make an investment and do not take on any debt, although they still need to account for the liability from the expected lease payments. The choice for leasing or another financing option is case specific and depends on many aspects such as:

- The direct financing costs compared to the lease payments;

- Legal aspects, such as the ownership situation and its implications, and the conditions for contract cancellation;

- Securities required by the lease provider;

- Tax issues;

- Accounting issues, e.g. who activates the investment;

- Other aspects, e.g. transaction costs, comprehensive consultancy.