Crowdfunding model

Description

Crowdfunding approach is an alternative method, completely different to the common typical business process, used to raise capital through small collective efforts (amounts of money) of a large number of people, friends, family members, customers and individual investors, and finance a project. In particular, it allows to know about a business even before it is launched, and is based on a network of people. Large investments have to be planned using multimedia information systems (text, audio, images, video, animations, …) that should persuade investors (no banks or other institutions involved) without providing guarantees of the business plan.

Nowadays, the crowdfunding for real estate sector is only applied to the U.S. market. In Europe, crowdfunding for real estate projects is not allowed yet, but there are various platforms that are already using the concept in different ways (e.g. banks are involved in this business and the amount of the investment is limited). Italy is an example of this approach, and even if it has been the first country to introduce a legal framework regarding equity crowdfunding, the market is still waiting for some changes in order to be as efficient as in the US.

The Crowdfunding scheme until now has been used to finance a wide range of projects in different fields, such as art, scientific research, medical, travel, social, civic projects, and only recently has been applied to renovation and the energy efficiency sector.

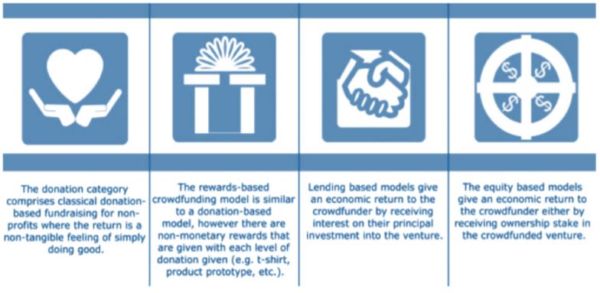

Crowdfunding can be classified into four different models, according to the revenue model as explained in the following figure:

- Donation Based Crowdfunding

- Rewards Crowdfunding

- Equity Crowdfunding

- Lending-based crowdfunding

"What” (value proposition)

This business model is used by project owners who want to raise money to finance a specific project. In case of rewards-based crowdfunding, project owner can give (often small) non-financial rewards in return. The rewards are of a symbolic value and provided by the investee. They are usually much lower than the donation amount, to ensure there is enough money left for the project. The donors are usually involved to renovate a building of public interest being it a public building or an historical one. In the lending based and equity based models, the involved actors are investors who gains economic return by their contribution to finance the project.

"Who” (target customer)

Crowdfunding is mainly based on the virtuous interaction of three types of actors:

- The founder (company), who develops the project idea and aims to realize it;

- A large crowd of people (investors), who support the idea with donations, rewards or loan crowdfunding (lending based crowdfunding);

- A web-platform and an organization that facilitates the intervention launching, financing, applying and sharing.

Target buildings for donation and rewards-based crowdfunding are usually public buildings (e.g. outdoor or indoor recreational places, social housing, co-housing), educational and historical buildings (e.g. historical places). Lending based and equity based models target are usually large apartment blocks, often luxury apartments assuring the highest return for the investors.

"How” (value chain, activities, resources)

Donation and rewards-based crowdfunding permits to collect money to invest in a project of public interest. An example is related to the investment in public or touristic places for the requalification of the zone, in this case, the return is not directly linked to money but is an investment on the territory. In the case of lending based and equity based models crowdfunding permits to collect money to invest in a project with an economic return for investors. It is an online investment where it is possible to buy a participation in a company. In the equity crowdfunding approach, investors bear risks. They may lose all or a portion of their investment but can earn high returns on investment.

Donation and rewards-based crowdfunding permits to collect money to invest in a project of public interest. An example is related to the investment in public or touristic places for the requalification of the zone, in this case, the return is not directly linked to money but is an investment on the territory. In the case of lending based and equity based models crowdfunding permits to collect money to invest in a project with an economic return for investors. It is an online investment where it is possible to buy a participation in a company. In the equity crowdfunding approach, investors bear risks. They may lose all or a portion of their investment but can earn high returns on investment.

"Why” (revenue model and cost structure)

For donation and rewards-based crowdfunding the sum collected through crowdfunding, usually with the support of a web platform, is a “pure” donation since investors are usually not strongly motivated by profit. This model attracts donation for a specific project development, donors know that their money will be used for this specific project and the reward has often a symbolic value with a usually much lower than the donation amount.

In the case of lending based and equity based models European platforms for crowdfunding in the real estate sector, where banks are always involved as capital providers, are often focused on the refurbishment of luxury buildings where the final building sale guarantee a higher amount of profit to pay the rewards.