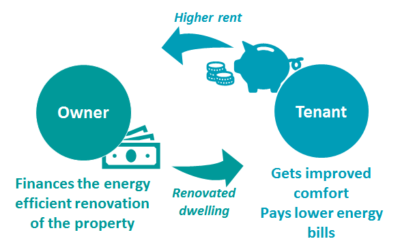

Financing through rent increase

Description

Building owners who do not occupy a building themselves or housing corporations can profit from additional revenue opportunities after undertaking investments for energy efficient measures if they are allowed to charge higher rent from their tenants after the renovation. The higher rent takes the tenant’s energy savings into account. This helps overcome the barrier of split incentives, i.e. the lack of incentives to realize building improvements when owner and occupant are different parties.

This business model is based on a regulation that allows such rent increases and is being introduced in a number of countries. Such regulation is possible in situations where a legislation on maximum rents and/or maximum allowable rent increases exists. This is usually the case in the social housing sector, but it may also exist in the wider residential rental sector where buildings are owned by private persons or property companies.

As this business model is based on a change in legislation regulating the rental sector, its attractiveness for the building owner directly depends on the details of the legislation, e.g. how much of the energy savings or of his up-front investment a building owner is allowed to recover. It is unlikely that being able to charge higher rents to tenants will be the sole driver for a property owner’s decision to undertake renovation measures. However, the higher rents may still play a significant role in the decision. It is expected that in its current form the business model is mostly applied for the implementation of energy efficiency measures which are usually more cost-effective than renewable energy technologies. But theoretically the business model may also be applied for the implementation of renewable energy technologies (RET), e.g. for the installation of a heat pump which reduces energy costs for the tenant. There are only few new business models and innovative policy instruments which specifically address the barrier of split incentives. This implies that this business model, potentially supported by additional incentives, may play an important role in catalyzing energy improvements of the existing building stock in the large rental sector.

The application of the business model is limited to countries or regions that have a regulated rental sector. In this sector, mostly large property owners are active, such as social housing corporations which frequently have the long time horizon, access to capital and technical expertise required to plan and undertake renovation measures.

RentalCal is an international research project funded by the European Union under the H2020 framework. The project aims at developing a methodology for the profitability assessment of energy efficient refurbishment investments in the rental housing sector. The second objective of RentalCal aims at providing comparable and transparent information on the profitability of energy efficiency investments that can be used both for the assessment of investment decisions, and for the comparative analysis of existing barriers in the private rental housing stock of participating countries. RentalCal specifically aims to prepare the ground for investment in the existing rental housing stock, all across EU.

"What” (value proposition)

- Financing of the renovation of the regulated rental sector through an increase of the rents

- Reduced operating costs of renovated buildings.

- Enhanced levels of comfort and satisfaction for building tenants

"Who” (target customer)

Applicable for renter-occupied residential buildings in jurisdictions where the rental sector is regulated through determined maximum levels of rent or maximum allowable rent increases. In the regulated rental sector mostly large property owners are active, such as social housing corporations which frequently have the long time horizon, access to capital and technical expertise required to plan and undertake renovation measures.

Applicable for renter-occupied residential buildings in jurisdictions where the rental sector is regulated through determined maximum levels of rent or maximum allowable rent increases. In the regulated rental sector mostly large property owners are active, such as social housing corporations which frequently have the long time horizon, access to capital and technical expertise required to plan and undertake renovation measures.

The relative share of social housing in the total building stock in EU countries is estimated to be on average 13%. The social housing sector is regulated in most EU countries .

"How” (value chain, activities, resources)

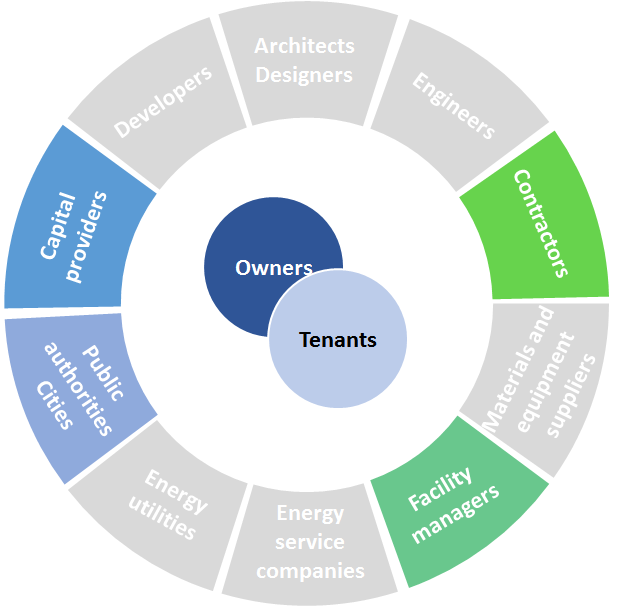

Directly involved actors are property owners (housing associations, individuals, corporate or institutional investors) and tenants. The business model also involves governments which set the rental regulations and other actors involved in the building sector such as installers of energy efficiency measures and energy auditors.

"Why” (revenue model and cost structure)

Cost structure: Cost of the renovation

Revenue stream: A building owner in a regulatory environment that allows higher rents for buildings with higher energy performance decides to undertake improvements to the energy performance of his property. To compensate for his investment, he increases the rent of his tenants who profit from lower energy costs. In doing so, the building owner aims at recovering his investment through the higher rents over a reasonable period of time.