On-bill financing

Description

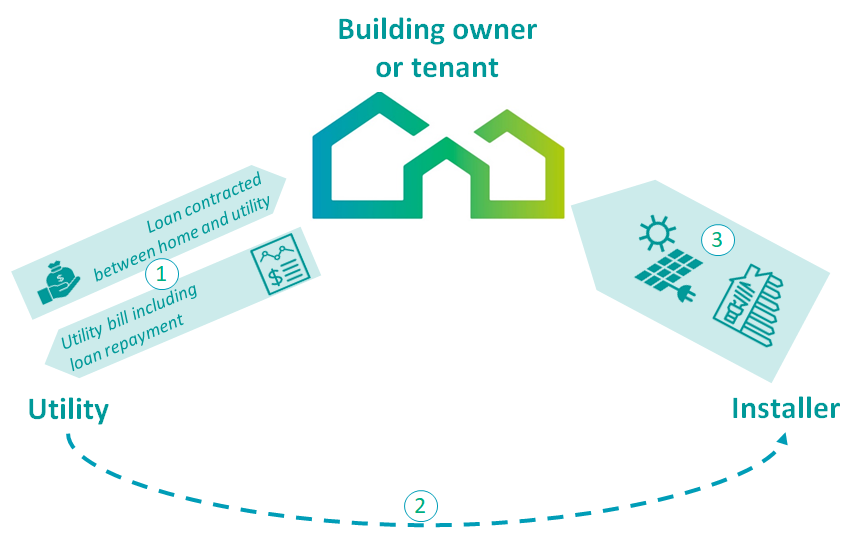

On-bill financing programmes are another model to cross the barrier of high up-front costs and access to capital. A utility provides capital to a home-owner for the installation of Renewable Energy Technologies (RET) or Energy Efficiency (EE) measures, and refund is made through the home-owner energy bill, i.e. building owners (or building users) repay the loans through an extra on their utility bills. Preferably, the overall utility bill should still be lowered thanks to the associated energy cost savings. Also, if the house is sold, it is possible to structure the programme in a way that the loan stays associated with the utility meter and can be transferred to the new owner.

Two types of programmes exist for the on-bill financing business model:

Two types of programmes exist for the on-bill financing business model:

- With an on-bill loan programme, a personal loan is issued to the building owner, repaid as a specific item on the utility bill (repayment periods are often set at around 5 years). However, it is legally not linked to the property or the utility meter;

- In on-bill tariff programme, the building owner also repays the loan via the utility bill (repayment periods are often set at around 10 years), but in this case it is considered as an ‘essential service’ and own part of tariff. The obligation for payments stays with the property and is transferred to the next owner in the case of sale of the property.

Generally, the target for the investments in RE and EE measures is to generate positive cash flows for the property owner, so repayment periods vary depending on the expected energy savings and the useful life of the installed measures.

In the on-bill financing business model, the utility does not only administer the programme and collect payments via electricity bills, but it also finances the investments from its own capital.

"What” (value proposition)

For building owner / user:

- Overcomes the barrier of high capital expenditure costs, as it allows building owners to apply RET and EE measures with limited or no own capital outlay;

- Interest rates may be significantly lower than if the building owner would arrange for financing himself through a bank;

- Generally, investments are structured in a way that there are net energy cost savings for the building owner. For the customer, it is easy to see potential cost savings on his utility bill by comparing bills before and after the installation of RE and EE measures;

- In an on-bill tariff programme, the liability stays with the utility meter, and may thus be not classified as personal debt, so lower in-come borrowers, unable to take on additional debt, may also participate in the programme;

- Frequently, the utility guarantees the performance of the installed equipment, building owner or user would not be liable if technical problems occur.

For the utility:

- Linking payments to utility bills offer a relatively secure way of recovering the loan, which lead to attractive interest rates due to the lower default risk. However, engaging with lower income property owners may still increase the risk of default for the utility;

- The customer loyalty is higher: customers might be less inclined to change supplier as they are bound by a loan;

- In on-bill tariff programmes, utilities can disconnect customers from utility services in case of default of payment.

"Who” (target customer)

Two possibilities of profile:

Two possibilities of profile:

- Owners of single family houses and small commercial buildings who want to refurbish existing buildings;

- Owner occupied and renter occupied apartment buildings

The mechanism worked well for small businesses which require simple, turnkey approaches to improve their energy efficiency and for private owners of residential buildings seeking financing for modest energy efficiency measures.

"How” (value chain, activities, resources)

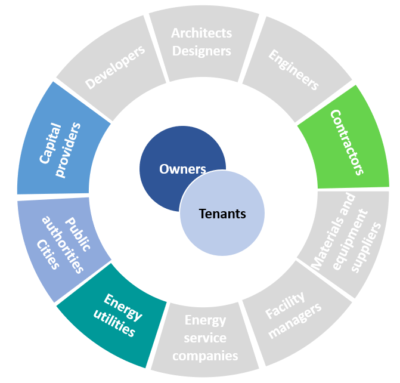

On-bill financing programmes are set-up by utilities. In addition, they involve building owners, who decide to initiate RET and EE measures. Utilities are frequently able to finance the programmes themselves as they have enough equity capital and access to debt facilities. However, the utility may also rely on additional partners for financing, such as banks or government bodies, through revolving funds. Installers of RE equipment may be involved by partnering with the utility.

Utilities planning an on-bill financing programme can also consider partnering with specialists such as installers, service companies undertaking energy audits, banks and ESCOs. Especially the role of installers and contractors may be critical for successful programs.

"Why” (revenue model and cost structure)

On-bill financing generally generates annual cost savings for the building owner within the loan term (which must be shorter than the useful life of the equipment. Thus, only cost-effective measures are financed. On bill-financing programmes are often combined with grants to be cost-effective.