One-Stop-Shop provided by contractors’ cluster cooperation

Description

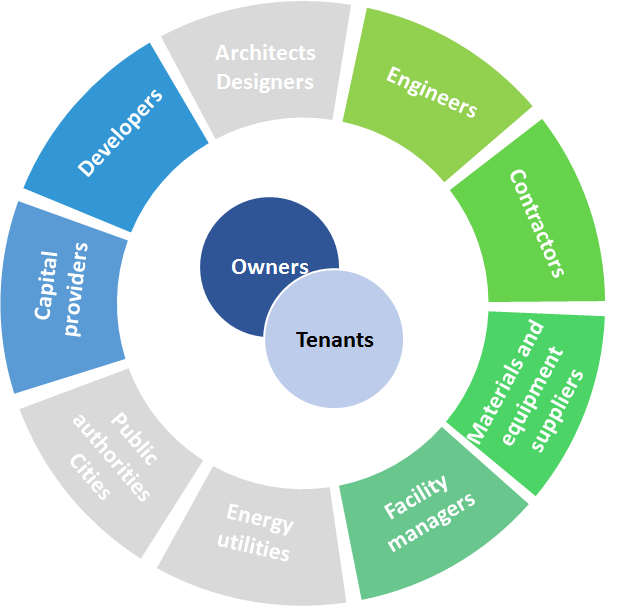

In today’s construction industry a movement from conventional competition and contract models towards new partnership and collaborative business models can be observed. These partnership business models comprise management and manufacturing methods and correspond more to real businesses in the construction industry. This progress of the market within the construction sector leads to a usage of new business models also in order to overcome traditional price-driven competition towards a more collaborative working environment and a value-driven competition. Moreover, each large building retrofitting project needs slightly different business models according to building ownership, building typology, scope of the retrofitting, requirements, barriers such as available financing, actors engaged, guarantees, referenced projects, etc. The actors in the retrofitting project life cycle should be able to choose the optimal business model, and should be able to realise it (organisation, contracts, resources, knowledge, and technical competences). Solid and well-defined methodology and digital tools are needed for the project based on development and implementation of these novel business models. An individual SME is limited in many ways to reach these goals. The only solution is a collaborative, cluster or networked based approach.

In this context, it may happen that the service provider of the One-Stop-Shop business model is a team of contractors that may all be SMEs or with a major contractor and its affiliated partners. Small-medium sized construction companies may thus enter into partnerships with other actors such as suppliers of key components/material and architect/engineering company if these capabilities do not exist in house.

In case of SME cluster collaboration, generally, the SMEs scope, competences and resources are limited for developing large construction investments, for example large real-estate retrofitting projects. Mainly in the public sector, where the competition is based on the “lowest price” criterion, the SMEs have many difficulties to win the projects. An important opportunity is the adaptability and flexibility of SMEs to different contractual arrangements. This can be implemented only by a group of companies covering all required competences, in well-organised collaborative approach. The operation and maintenance organisation and end-users should be directly involved. These actors have key impact on high performing buildings (retrofitted buildings) and with that also on the overall outcome (economic, environmental, social) of the retrofitting project.

In this framework, SMEs operating in the construction field and in the same region may look for a holistic coverage of the construction industry market, applying business models which can be profitable by fulfilling a wide spectrum of clients’ requirements. Clusters of regionally active construction SMEs have an increasingly need to be organised into networks or strategic alliances. This will answer to the business opportunities, which require individual resources such as specific expertise, workforce or equipment. For widening the range of competences some of them enter even wider association such as e.g. German Facility Management Association (GEFMA).

Nevertheless it has to be underlined that when the client is from the public sector, it is necessary to define the leader of the SME cluster to be possible to contract projects. Definition of the leading SME partner can be a problem. Legal issues have to be cared about (contract forms, assurances in the case of SME bankruptcy, responsibilities and guarantees for longer time).

"What” (value proposition)

- Cluster of SMEs with a very informal structure can act as a big company but yet without expensive bureaucracy. Since the structure is not fixed, a cluster can adjust to each project both in size and differentiation of expertise. Deep specialisation is possible if the cluster is formed to cover all the necessary functionalities (all for one and one for all). Information on good practices, best (the most appropriate) retrofitting technologies, materials and system implemented is a valuable knowledge base for future projects.

- Non-local partners (e.g. in the case of offshoring) are motivated for a daily use of ICT instead of meeting in person by encouraging of teleworking, videoconferencing, common data storage, knowledge base.

- Since there are more independent partners, the vulnerability of the whole cluster is lower.

- The change of one partner in case of a problem is faster and more transparent to all partners than in case of problems in one department of a big company.

Added values are also:

- Comprehensive approach and integrated design

- Sustainable performance based on life cycle approach

- Overall project management

- Supervision of retrofit work

- Quality assurance scheme and its implementation

- Commissioning and handover

"Who” (target customer)

Individual houses (one owner), non residential buildings (mix or individual ownership), multifamily buildings (many owner), public buildings (schools, hospitals, offices) may be targeted by the service provider represented by the cluster of contractors.

Individual houses (one owner), non residential buildings (mix or individual ownership), multifamily buildings (many owner), public buildings (schools, hospitals, offices) may be targeted by the service provider represented by the cluster of contractors.

"How” (value chain, activities, resources)

Key activities are: marketing, consultancy on best technologies, cluster set-up and management, negotiation and bidding. Key partners shall be found for financing (ESCO, bank, ECO fund, etc) and investment schemes as well as subsidies.

"Why” (revenue model and cost structure)

Cost structure: Direct project costs involved in traditional renovation (labour, material, free of cost building inspection), overhead, supporting costs (i.e. guaranties), marketing costs, costs for post-renovation commissioning and information material

Revenue streams: Combination of different financing sources (client’s own funds, subsidies, bank loan, ESCO, etc.), payment from customers for renovation work, commission from suppliers