One-Stop-Shop with home-based financing

Description

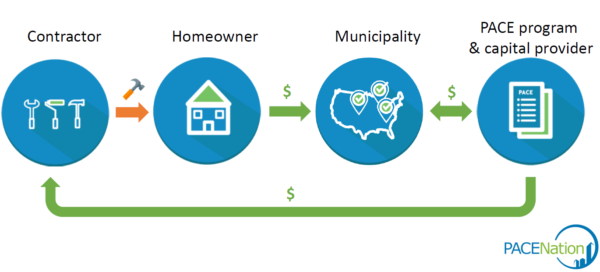

This business models took inspiration from the Property Assessed Clean Energy (PACE) concept, widely piloted in the US, where local governments issue bonds for renovation projects.

The building owner repays the loan through an additional special “assessment” payment on its property tax bill for a specified term. These “assessments” are comparable to loans as the property owner pays off its debt in instalments over a period of various years but from a legal point of view they are not considered as such.

When the property changes ownership, the remaining debt is transferred with the property to the new owner. In other words, PACE financing is a mechanism set up by a municipal government by which property owners finance energy efficiency and renewable energy measures via an additional tax on their property. The property owners repay the “assessment” over a period of 15 to 20 years through an increase in their property tax bills. In the US, property tax payments are made annually or in arrears but payment modalities may be different in other countries, especially in Europe.

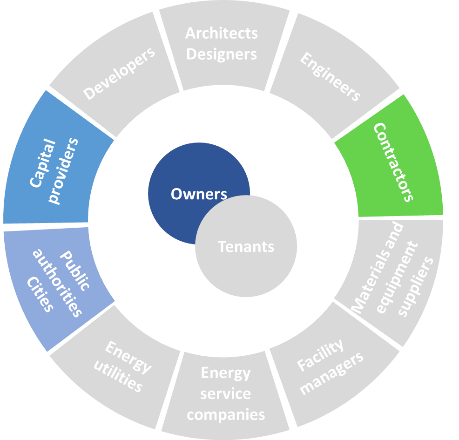

The PACE concept is being adapted to Europe by the EUROPACE project. As in PACE, the innovative character of the EUROPACE mechanism is that financing is linked to the taxes paid on a property. In other words, the financing lent by a private investor is repaid through property taxes and other charges related to the buildings. The EUROPACE mechanism also sets up of One Stop Shop by engaging several stakeholders in the process: local government, investors, equipment installers, and homeowners.

Recommendations for replication

In the framework of the EUROPACE Project an in-depth analysis to assess the legal and fiscal readiness for the adoption of an on-tax financing mechanism across EU28 was developed. The main key factors are hereby reported.

The important elements for the success of this business model are:

- Suitability of the legal framework for on-tax financing: As EUROPACE is added to property taxes, the suitability of the legal framework is important an important factor to consider to assess the on-tax financing mechanism replicability. Property taxes differ in many aspects between countries but issues such as the existence of a property-related tax, the regular collection of property taxes, or a relatively low level of exceptions in the tax collection mechanism are essential for the legal implementation of this business model.

- Municipal capacity to develop an on-tax financing mechanism and municipalities’ experience and policy objectives concerning EE and/or climate mitigation: Municipalities play a vital role in the EUROPACE business model, as they have an interest in implementing EE solutions and are also relevant actors in the creation of private-public partnerships (PPPs). The experience of municipalities in working on comparable assignments and to estimate their readiness to implement EUROPACE, can be assessed referring mainly to municipalities’ capacities to manage EE projects, particularly in a PPP model. According to the best practices from PACE implementation in the US, a key indicator for replicability is a case where the municipality has experience working with the private sector to implement broadly defined investment programmes. Another key indicator for replicability is the existence of EE programmes and policies in buildings

- >Enforceability of local taxes and/or property taxes and assessment of charges, defaults, and delinquencies: The enforceability of local taxes and/or property taxes and an assessment of charges, defaults, and delinquencies assesses as well the roles and responsibilities of the local authorities that provide guarantees (including senior liens) to investors. In particular, this replicability indicator focuses on the progress made towards fair, standardised, and transparent administrative processes as well as possible penalties, tax liens, and, eventually, foreclosure procedures in cases of the non-payment of taxes. A fully developed guarantee mechanism over the payment of property taxes is considered as a key enabler.

- Political, institutional, and social perceptions and acceptance of EUROPACE: It is difficult to compare the attitude towards property taxes, as these vary significantly among the countries analysed. There is a vast set of secondary country-specific data on the impact local taxes have on elections and on local and national debate in general. While in some countries politicians barely mention the importance of local taxes, in other, increases in local taxes lead to mass protests and can determine the results of local (or central, if the government is fully in charge of local taxation) elections. In principle, it can be concluded that the more stable and institutionally continuous the tax is, the easier it will be to use it as a basis for EUROPACE implementation.

"What” (value proposition)

The business model provides the following advantages for the customer:

- 100% upfront financing (mostly through green bonds), with long-term financing of up to 20 years

- Can be combined with utility, local, regional, and state incentive programs

- Financing is attached to the property and can be transferred to a new owner upon sale

- Financing is repaid with regular property taxes

- Simple and clear value proposition that speaks directly to people’s needs

- Local energy services contractors act as local sales force (“PACE providers”)

- Digital platform allows for quick and easy approvals of applications to the programme

- Technical and customer assistance is provided throughout the process

- Comprehensive consumer protection policies

"Who” (target customer)

The customer segments targeted by this innovative financing scheme are in principle all building owners eligible for property taxes with a particular focus on small, residential and commercial buildings since these business models enable a long-term approach where building owners can spread the investment costs across the project life time. The model is relatively new, and current programmes in the U.S. apply to owners of existing free-standing residential houses and commercial buildings.

The customer segments targeted by this innovative financing scheme are in principle all building owners eligible for property taxes with a particular focus on small, residential and commercial buildings since these business models enable a long-term approach where building owners can spread the investment costs across the project life time. The model is relatively new, and current programmes in the U.S. apply to owners of existing free-standing residential houses and commercial buildings.

"How” (value chain, activities, resources)

Payments are collected using existing tax mechanisms: This so called on-tax financing is a type of financing mechanism used to collect repayments for investments in building improvements that meet a ‘valid public purpose’, e.g. save or produce energy. Typically, investors lend money for deep retrofits up-front and then get repaid regularly through an additional charge on a tax bill. The EU project EuroPACE (see below for more details) is a form of on-tax financing and it builds upon an existing relationship that municipalities have with their citizens – the property tax system. The local tax agency acts as the collecting agent for the repayments. Training is also provided to local contractors.

"Why” (revenue model and cost structure)

For the owner: Upfront long-term financing: The funding covers 100% of all projects hard and soft costs and frees up disposable income for families and capital for businesses. Low interest rates for terms up to 20 years, while standard bank loans rarely exceed 5 to 7 years. PACE financing instruments aim at selecting energy efficiency and renewable energy solutions in a way that the additional property tax payment is lower than the cost savings achieved, thus aiming at annual net cost savings for the building owner.

For the local government/ local authorities: unlocking of investment in energy efficiency thanks to green bonds.