3

10, 2019

By Nicolas PERAUDEAU|2019-10-03T11:56:08+02:00October 3rd, 2019|

The renovation of Sneinton district was implemented in the framework of the H2020 funded REMOURBAN project (http:// http://www.remourban.eu/).

The project included the renovation of a variety of property typologies in Nottingham within the Sneinton area ranging from single-family to multi-family houses, and in age, from 1900 to the 70s. A large number of the properties (65%) in the area are social housing, owned by Nottingham City Council (public owner) and managed on their behalf by Nottingham City Homes. The project included both energy efficiency measures (mainly walls insulation) and the connection to district heating.

As this project was also part of the Energiesprong UK programme, an “Energiesprong-type” package (with prefabricated façade) has been implemented.

Regarding financing, each home owner/private landlord received a Remourban grant towards the work, leaving a contribution of between 1.400€ and 2.536€ (£1,260 - £2,280) to pay, depending on the property type. Without the grant, this home improvement would normally cost upwards of 8.900€ (£8,000).

2

10, 2019

By Nicolas PERAUDEAU|2019-10-02T17:05:12+02:00October 2nd, 2019|

The renovation of this residential building locate in Munich was implemented in the framework of the FP7 funded E2Rebuild project (http://www.e2rebuild.eu/).

The residential multi-storey building in the suburb of Sendling, Munich (Germany), owned by the public housing company GWG München and made up of uniform standard concrete brick blocks, was built in the post-war decade of the 1950s. The building has been fully retrofitted, including the replacement of the attic by an additional floor to create more rental space, increasing the Net Dwelling Area to 3.323 m2 (originally 2.012 m2, + 65 %, phase 2 + 155 %).

The main refurbishment actions performed included:

- TES Energy Facades, prefabricated with cellulose insulation added to existing outside walls, U-wall 0,12 W/m²K. Painted timber windows with triple glazing, U-window 0,9 W/m²K and outside solar control fixtures.

- The roof consists of visible timber beam construction, highly insulated with U-roof 0.11 W/m²K and greening on top. Accessible terraces and thermal solar collectors occupy the whole surface area.

- Central (residual) heating system (CHP combined heat + power, planned before: wood pellet boiler plant), two central heat storage tanks (20 m3) with dual piping system and fresh hot water substations.

- Space heating and domestic hot water assisted by two solar thermal collector systems (208 m²) over green roofs, (solar photovoltaic system proportionally provided over green roofs of building phase 2).

- Controlled ventilation of flats (fresh and waste air) with heat recovery, distributed system for flats (facilitated fire safety, lower costs), centralised in the new building for the district office and habitations.

2

10, 2019

By Nicolas PERAUDEAU|2019-10-03T12:04:48+02:00October 2nd, 2019|

The renovation plan for the primary school “St. Kiril and Methodius” was developed in the framework of the EuroPHit project (https://europhit.eu/) co-funded by the Intelligent Energy Europe Programme of the European Union. The renovation plan follows a Step-by-Step Business Model approach, aiming at achieving the EnerPhit standard, based on the Passive House principles.

The building was constructed in 1970. It has a concrete structure with external brick walls and a concrete flat double ventilated roof, and no insultaion was installed. Since 2013, the school has been connected to the central gas heating.

The renovation work included improvement of the building envelope with new thermal insulation on the roofs, on the external walls, on the ground walls and the slabs on the ground. Furhtermore, the windows were exchanged when their lifespan was over.

The project proposed the following refurbishment steps:

- STEP 1- roof insulation – placing 30 cm. glass wool insulation on the top of the lower slab of the ventilated double roof.

- STEP 2 – mounting 20 cm EPS with graphite insulation on the walls, reduction of the radiator dimensions, improving the airtightness layer, implementation of the ventilation with heat recovery systems.

- STEP 3 – External underground wall insulation, perimeter insulation, insulation above the ground floor slab in the gym.

- STEP 5 – Replacement of windows: the PVC windows will be replaced in 10 years, when they will be 20 years old. The aluminum windows will be replaced in 20 years, when they will be 30 years old.

- STEP 6 – Implementation of Renewable Energy Sources (Photovoltaic panels)

2

10, 2019

By Karine Laffont-Eloire|2019-10-04T09:35:45+02:00October 2nd, 2019|

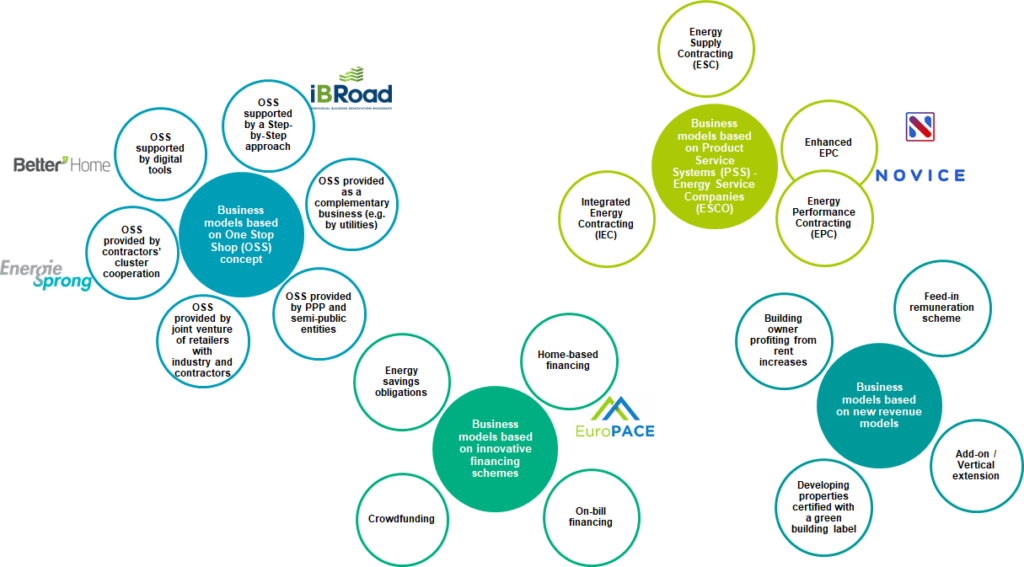

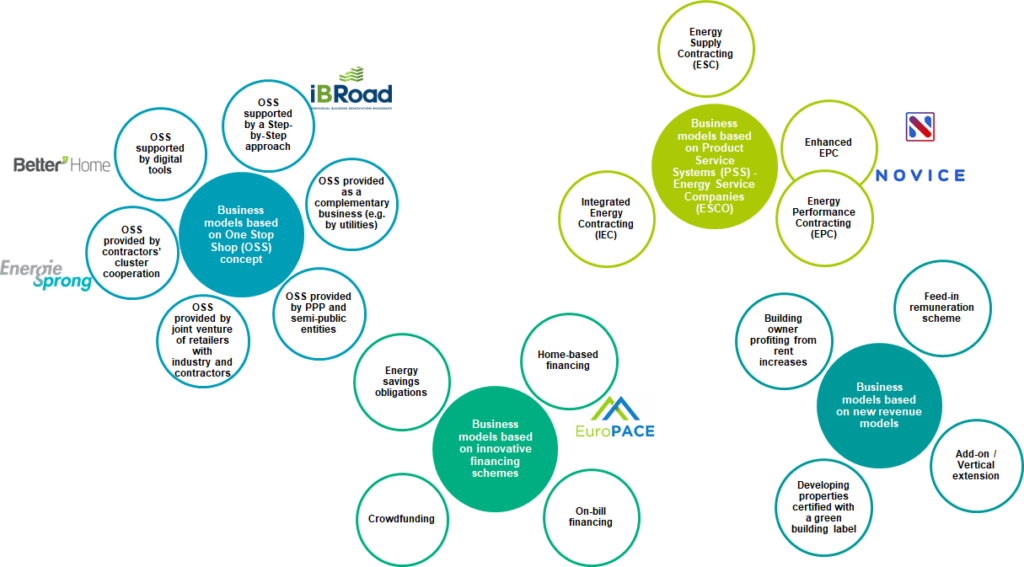

The objective of this section of the Renovation Hub is to present the variety of Business Models that already exist to support energy renovation, guide you in this large collection to find the best “recipe”, provide recommendations for replication, and illustrate the application of most promising ones through Cases Studies.

We have identified four main families of business models:

Real business models are often a combination of several business model patterns, and business model families should not be considered in isolation: on the contrary, combining several patterns can provide a more robust business model.

When setting up a renovation project, the chosen business model(s) should be tailored to the targeted market segment:

Real business models are often a combination of several business model patterns, and business model families should not be considered in isolation: on the contrary, combining several patterns can provide a more robust business model.

When setting up a renovation project, the chosen business model(s) should be tailored to the targeted market segment:

Other types of Business Models you may be interested in:

Each Business Model presentation is structured in four blocks: What? Who? How? Why?

Real business models are often a combination of several business model patterns, and business model families should not be considered in isolation: on the contrary, combining several patterns can provide a more robust business model.

When setting up a renovation project, the chosen business model(s) should be tailored to the targeted market segment:

Real business models are often a combination of several business model patterns, and business model families should not be considered in isolation: on the contrary, combining several patterns can provide a more robust business model.

When setting up a renovation project, the chosen business model(s) should be tailored to the targeted market segment:

| For who? | The problem |

What? (Recommended Business Model) |

How? |

Can be combined with: | Where? (Example of countries with high potential for this BM) | |

| Type of dwelling | Type of owner | |||||

|

Owner occupant | Renovation journey too costly and complex for the home owner | One Stop Shop | Provided by PPP / semi-public entities | Countries with incentives for home owners to renovate | |

| Supported by a digital tool | Denmark, Germany | |||||

|

Social housing | Renovation in occupied dwellings. Acceptance by tenants | One-Stop-Shop “Energiesprong” | Initiated by a dedicated marketing team | Add-on business model | Netherland, Denmark, Germany, UK |

| Energy Performance Contracting | Provided by an ESCO | Collective Self Consumption | France, Denmark | |||

|

Condominiums | Renovation in occupied dwellings. Acceptance by multiple owners. | One Stop Shop | Provided by semi-public entities | Step by Step approach | Germany, France, Denmark |

|

Public buildings | Upfront investment. Long term estate management | Energy Performance Contracting | Provided by an ESCO | Crowdfunding (for cultural heritage) | France, Denmark |

|

Offices and other tertiary buildings | Attractivity of estates for companies / lessees | Energy Performance Contracting | Provided by an ESCO | France, Denmark | |

Other One-Stop-Shops Energy as a service: New and innovative revenue models New financing schemes

Each Business Model presentation is structured in four blocks: What? Who? How? Why?

2

10, 2019

By Karine Laffont-Eloire|2019-11-26T10:03:19+02:00October 2nd, 2019|

In this business model the key player is supported by digital tools guiding home-owners as well as designers (or contractors) in the initial planning of the renovation work. The tool usually acts as a guide to optimize the application of the overall retrofitting process by for example collecting all the information related to the initial state of the building to be renovated and the preferences, the needs and desiderata of the building owner. The ICT tool processes the information gathered and suggests an optimised approach to the renovation project.

The main advantage is the possibility to effectively manage the whole process in a comprehensive way. As the idea is very much based on creation and availability of process descriptions, checklists and tools, the maintenance and update of the material are key. It is also highly important to be able to create reliable initial information about the building stock and provide robust initial model. In order to make reliable assessment about the saving potentials in terms of energy and costs, the actors involved must be able to use appropriately the tools for energy performance assessment and be able to make justified conclusions about the savings. Here the quality of the initial information is highly important. In addition, a solid understanding of the users’ behaviour and willingness to commit to energy savings is essential.

An example of this business model is BetterHome in Denmark, an industry-driven one-stop-shop model, which has proven successful in boosting demand for holistic energy renovations in Denmark, since the model was launched in 2014. It was profitable after just three years, with 200 projects in 2016 and is expected to continue its growth. Understanding that renovating a building is a big commitment, this model creates a burden-free experience for the building owner and offers a service that goes beyond replacing building components. The home-owner-centric renovation journey has two main mechanisms: structuring the process for the installers and increasing building owners’ awareness.

Recommendations for replication

While the central aspects of the renovation journey are replicable on most European markets, the model must be adapted to the local context. Applying a similar model in other countries will require a greater focus on quality assurance and an integration of financial support into the model. In Denmark, quality assurance is heavily regulated, including guarantees for the building owners. A more comprehensive quality and compliance scheme is required on most of the other European markets. Furthermore, the available financial subsidy scheme for energy renovations in Denmark is modest and rarely decisive for the building owners’ decision to invest. In countries with substantial public support schemes for energy renovations, this can be incorporated into the business model. Key factors for replication are:

- Use digital solutions to bring added value to the end-users: BetterHome shows that digital solutions can help the construction industry become more consumer-centric and service oriented. Moreover, with the use of innovative digital tools, building professionals can provide a smoother process, for themselves and for the building owner. Aligning with existing stakeholders on the market, including banks and mortgage providers, creates a constructive win-win situation.

- Structure the supply-side: The success of the home-owner-centric business model can be explained by the advanced service-oriented role of the installers. BetterHome trains and guides the installers on how to approach the home-owner, from the first contact to the finalisation of the process. In support, BetterHome also simplifies and structures the renovation process for the installer, through supportive and innovative digital tools, enabling a better evolution for all involved.

- Build awareness for the end-users: Training the installers in order to sell the broader picture, including benefits (e.g. low interest rates, increase in property value, improvements to health of their children and comfort, as well as climate and environmental benefits). The installer is not just replacing the old building elements, but creating a better living environment.

- Safeguard the good reputation: In Denmark, the four companies behind BetterHome are highly respected and associated with quality. Through the cooperation in BetterHome, the companies have worked together to also raise the reputation of the installers.

2

10, 2019

By Karine Laffont-Eloire|2019-10-04T10:27:57+02:00October 2nd, 2019|

The Step-by-Step renovation model is a widely diffused model of building refurbishment that consists in the replacement of different building components (such as windows, plasterwork, roof covering, boiler etc.) according to their life duration.

One of the benefits of such an approach is that it gets the most out of each building component so that the initial investment is taken advantage of to its fullest. The need for replacements of various components arises at different points in time which means that in the case of a complete building retrofit, components that are still intact are renewed unnecessarily before their due time, leading to sub-optimal investments. With the step-by-step approach this can be avoided. When applying this approach, a building renovation plan should be made for all measures, including those which lie in the distant future, before starting the work. In this way, it can be ensured that an optimal end result is achieved in terms of cost-effectiveness, energy efficiency and quality.

Recommendations for replication

One of the benefits of such an approach is that it gets the most out of each building component so that the initial investment is taken advantage of to its fullest. The need for replacements of various components arises at different points in time which means that in the case of a complete building retrofit, components that are still intact are renewed unnecessarily before their due time, leading to sub-optimal investments. With the step-by-step approach this can be avoided. When applying this approach, a building renovation plan should be made for all measures, including those which lie in the distant future, before starting the work. In this way, it can be ensured that an optimal end result is achieved in terms of cost-effectiveness, energy efficiency and quality.

Recommendations for replication

One of the benefits of such an approach is that it gets the most out of each building component so that the initial investment is taken advantage of to its fullest. The need for replacements of various components arises at different points in time which means that in the case of a complete building retrofit, components that are still intact are renewed unnecessarily before their due time, leading to sub-optimal investments. With the step-by-step approach this can be avoided. When applying this approach, a building renovation plan should be made for all measures, including those which lie in the distant future, before starting the work. In this way, it can be ensured that an optimal end result is achieved in terms of cost-effectiveness, energy efficiency and quality.

Recommendations for replication

One of the benefits of such an approach is that it gets the most out of each building component so that the initial investment is taken advantage of to its fullest. The need for replacements of various components arises at different points in time which means that in the case of a complete building retrofit, components that are still intact are renewed unnecessarily before their due time, leading to sub-optimal investments. With the step-by-step approach this can be avoided. When applying this approach, a building renovation plan should be made for all measures, including those which lie in the distant future, before starting the work. In this way, it can be ensured that an optimal end result is achieved in terms of cost-effectiveness, energy efficiency and quality.

Recommendations for replication

The step-by-step approach is probably the most likely to be replicated as it minimises the main obstacle to the process of energy renovation of buildings, i.e. the high initial investment. It is the approach that is most suitable for small investors with a prudent attitude, who aim to improve their living conditions and who do not immediately seek a significant increase in property value. The main advantage lies in the possibility to check, after each intervention, the benefits in terms of comfort and energy savings, splitting the risk between smaller investments, as well as keeping the possibility to make corrections in the course of future interventions. The important elements for the success of this business model are:

- Technical know-how of the OSS consultants who advise clients:The interventions carried out in the early stages will have to be compatible with the interventions planned in the future, possibly avoiding unnecessary redundancies, and therefore the allocation of costs in interventions that will not generate savings.

- High percentage of dwellings occupied by owners: Statistically, homeowners are more likely to carry out improvement works.

- Cumulation of incentives over time: In order not to decrease the interventions after the first one, it is essential that the incentives accrued during the various interventions are compatible and cumulative.

- Acceptable level of income and possibility to take advantage of incentives provided as tax deduction: As highlighted by Ameli & Brandt, 2015 the level of income is one of the parameters most closely related to the probability of investing in energy efficiency. Obviously, it has to be weighed against the cost of living, energy and, above all, the average cost of investment.